项目介绍

SKEMA商学院的金融市场和投资硕士项目是学校的拳头项目之一。项目在2017年最新的FT金融时报金融学硕士(Master in Finance)排名中位列世界第6,排名非常高。项目分为两个校区,各有不同的细分方向。项目由资深的教授授课,教授有的来自于学术背景,有的来自于金融企业。项目的课程重视实践以及解决问题的方式,使得学生在毕业后可以直接胜任金融企业的工作。为了适应金融行业的快速变化,这个项目也一直在调整专业方向和课程的设置,是学生可以学到最新的金融市场方面的知识(比如说在巴黎校区的Asset Management资产管理方向就开设了区块链和金融科技的课程)。

在最新的2017年金融时报金融学硕士排名中,这个项目位列世界金融学硕士项目第6。

The MSc in Financial Markets and Investments is a market-driven finance programme that closely reflects the constantly changing world of international finance. The teaching and curriculum use a practical approach.

The programme gives students practical expertise in the key areas of finance within the post crisis financial environment in the fields of trading, risk management, sales, investment advisory, structuring finance… Content is taught within a global macro-economic and financial environment with market-oriented courses that will enable the students to become conscious of a new financial and economic environment including a key component that may remain with them throughout their careers: a stockpile of world debt.

The availability of Bloomberg terminals with existing live quotes and up-to-the-minute financial information from different exchanges allows students to follow and better understand the correlation between geopolitics, economics and the financial markets.

专业方向

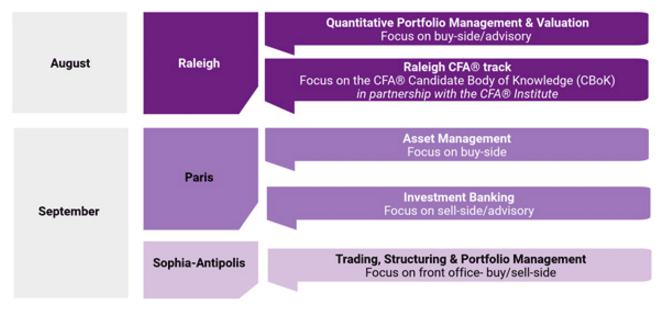

巴黎校区 Asset Management 资产管理;Investment Banking 投资银行

尼斯索菲亚校区 Trading, Structuring & Portfolio Management 交易,架构和投资组合管理

就业方向

- Trader

- Broker

- Sales analyst

- Risk manager

- Controller

- Investment advisory

课程详细

核心课程

| Semester 1 第一学期 |

| Introducation Stochastic Calculus |

随机微积分导论 |

| Financial Econometrics (with R) |

金融计量经济学(R语言) |

| VBA |

VBA |

| Applied VBA |

VBA应用(资产估值项目) |

| Excel Modeling |

Excel建模 |

| Fixed Income |

固定收益产品 |

| Equitiy Valuation & Financial Analysis |

资产估值和金融分析 |

| Derivatives |

衍生品 |

| Macro-Economics, Global |

全球宏观经济 |

| How Financial Markets Work |

金融市场的运作 |

| Bloomberg Data Analysis |

布隆伯格数据分析 |

| Country Risk |

国家风险 |

| Semester 2 第二学期 |

| Portfolio Management |

投资组合管理 |

| Simulation Game: Portfolio allocation contest (on Bloomberg) |

商业模拟:资产配置竞赛 |

| Fixed Income |

固定收益产品 |

| Credit Risk Exposure CVA |

信用分析敞口 |

| Financing/Investment Strategy (ECM & DCM) |

融资/投资战略(ECM和DCM) |

| My SQL Programming |

My SQL数据库编程 |

| Compliance & Ethics |

合规和道德 |

巴黎校区 Asset Management 资产管理方向课程

| Applied Financial Econometrics |

应用计量金融学 |

| Private Equity |

私募基金 |

| Alternative Investments |

另类投资 |

| Advanced Derivatives & Structured Products |

高级衍生品和结构化产品 |

| Applied Technical Analysis with Bloomberg |

Bloomberg应用技术分析 |

| Investment Fund France |

法国投资基金 |

| ETF Investment |

ETF基金投资 |

| Blockchain & Fintech |

区块链和金融科技 |

巴黎校区 Investment Banking 投资银行方向课程

| Investment Valuation, LBO & Private Equity |

投资估值,杠杆收购和私募基金 |

| M&A and Restructuring |

合并和收购以及重组 |

| ALM (Asset Liability Management) & Strategic Asset Valuation |

资产和负债管理以及战略资产估值 |

| Banking Risk Management & Behavioural Finance |

银行风险管理和行为金融学 |

| Deal & Negotiation Skills |

交易和谈判技巧 |

| Sales Methods |

销售方式 |

| Due Diligence & Investment Frame |

尽职调查和投资框架 |

| Basel Regulation |

巴塞尔规则 |

尼斯校区 Trading, Structuring & Portfolio Management 交易,架构和投资组合管理

| Equity & FX Structured Products |

资产和结构化产品 |

| Technical Analysis |

技术分析 |

| Exotic Options |

奇异期权 |

| Quantitative Portfolio Management |

计量投资组合管理 |

| Advanced Commodities |

高级大宗商品 |

| Fixed Income Structured Products |

固定收益结构化产品 |

| Option Book Management |

期权管理 |

| Quantitative Modeling of the value at Risk |

风险估值的数学建模 |

| Credit Default Swaps: Use, Pricing and Hedging |

信用违约互换:使用,定价和对冲 |

| Fintech: a new tool? |

金融科技:一个新的工具? |

| ETF Pricing and Trading |

ETF基金,定价和交易 |

|